AP Photo/Mark Lennihan

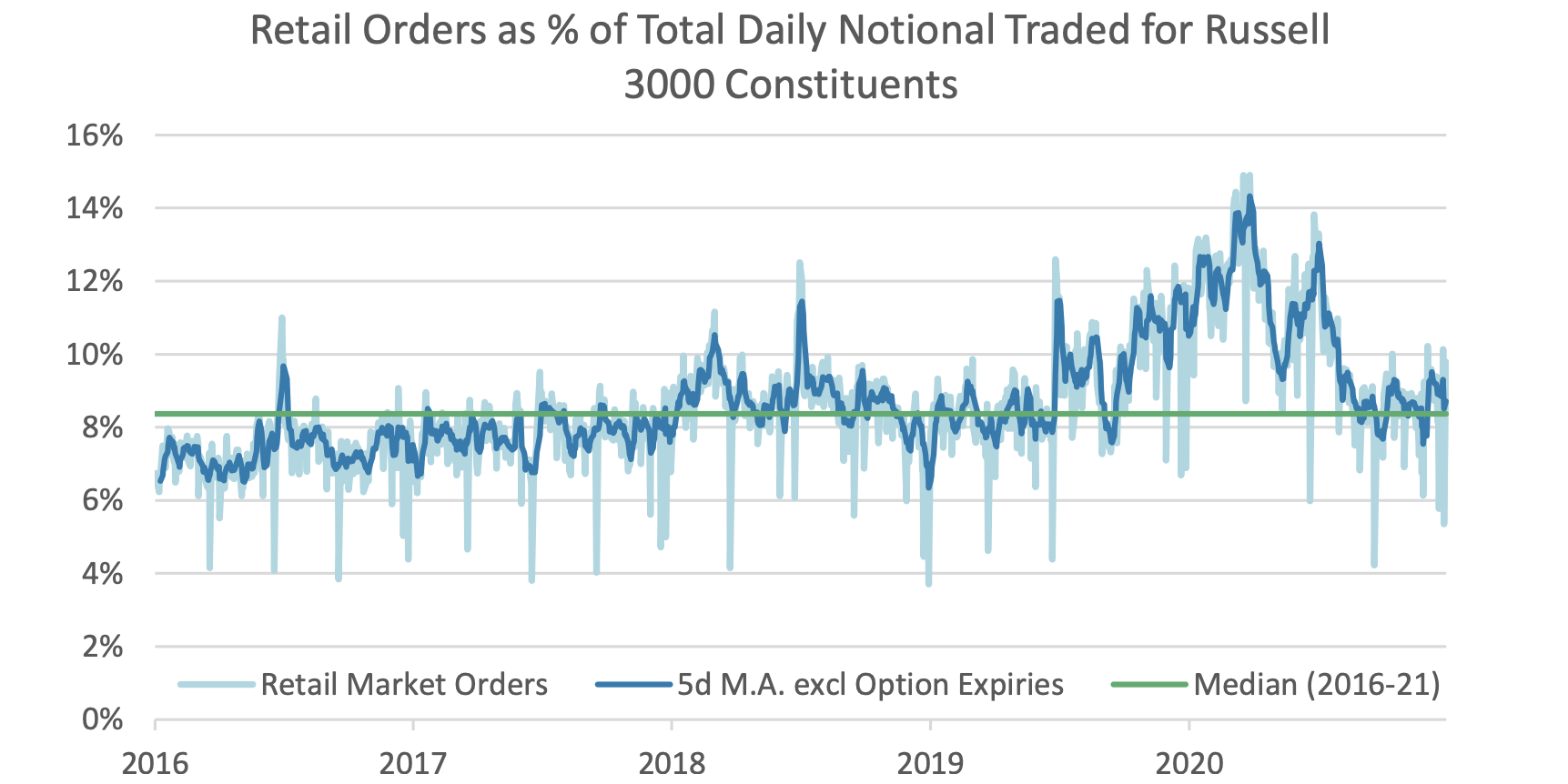

- Trades by retail investors in the US make up 10% of the volume on the Russell 3000, Morgan Stanley says.

- The rate has since cooled compared to the 15% in September 2020.

- "We find that retail investors tend to prefer companies in sectors they are likely to be familiar with as consumers."

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Retail trading activity in the US has cooled from its pandemic peak but still makes up 10% of stock trading volume on the Russell 3000, a broad benchmark of US stocks, according to a recent note by Morgan Stanley.

Retail activity stands at about 9.8%, lower than the 15% in September 2020 when participation was at its peak.

The GameStop frenzy in January and the meme stock phenomenon have both prompted many questions from clients who are trying to estimate retail activity, the bank said.

Morgan Stanley Research, Morgan Stanley Quantitative and Derivative Strategies

"We find that retail investors tend to prefer companies in sectors they are likely to be familiar with as consumers, such as consumer, discretionary, communication services, and technology," the bank said in a note on Wednesday.

This may explain why many meme stocks – a catch-all term referring to companies that have seen a recent spike in viral activity driving up their share price – often have a nostalgic connection to retail investors. The growing list includes AMC Entertainment, BlackBerry, Nokia, Bed Bath & Beyond, Beyond Meat, and Wendy's.

Retail investment within the communication services and discretionary sectors remained high, while those within the energy, materials, and industrials sectors picked up. Participation in the technology sector, however, declined, the bank said.

Morgan Stanley analyzed stock performances in the past five years from July 2016 to June 2021 and found that those with high retail participation outperformed those with lower retail participation over the subsequent month.

Retail investors, according to the bank, also seem to favor both illiquid micro-cap stocks and very liquid, mega-cap names.

"After removing the small, illiquid names from the analysis, we see a preference toward cyclicals, high-growth, positive momentum, and high volatility stocks," the bank said.

As of late, retail traders, many of whom congregate on sites such as Reddit, have been on the prowl for new meme stocks. Their latest targets include a tiny Texas oil driller Torchlight along with Danish biotech company Orphazyme.